Non-fungible tokens (NFTs) are in dire straits. With the market in a extreme downturn, it’s secure to imagine the NFT bubble has effectively and really burst.

It was by no means clear why these digital collectables traded for such giant quantities of cash. Now they largely don’t. What’s behind their flip of destiny? And is there any hope for his or her future?

What are NFTs?

Non-fungible tokens are a blockchain-based means to say distinctive “possession” of digital property. “Non-fungible” means distinctive, versus a “fungible” merchandise resembling a five-dollar invoice, which is similar as each different five-dollar invoice.

However simply because an merchandise is exclusive that doesn’t make it helpful. Digital property are simply copied, so an NFT is basically a receipt exhibiting you will have paid for one thing that different folks can get at no cost. It is a fairly doubtful foundation for worth.

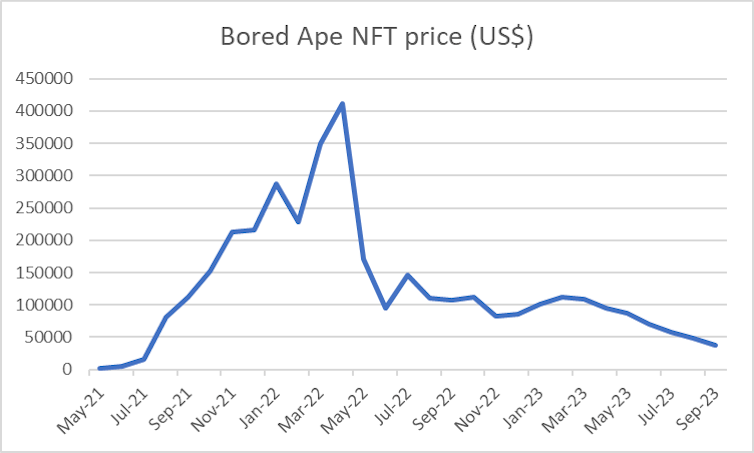

The two most traded sets of NFTs are the Bored Apes assortment created in April 2021 and the CryptoPunks assortment launched in June 2017.

Each units include 10,000 similar-looking however distinctive figures, distinguished by differing hairstyles, hats, pores and skin colours and so forth. The Bored Ape character appears spinoff of the drawings of Jamie Hewlett, the artist who drew Tank Lady and Damon Albarn’s digital band Gorillaz. The CryptoPunks are even much less attention-grabbing.

Why did folks purchase NFTs?

Though the primary NFTs emerged round a decade in the past, the pattern actually began to take off in 2021. And for a time NFTs have been very modern.

Even the venerable public sale home Sotheby’s, based in 1744, jumped on the NFT bandwagon. Sotheby’s offered 101 Bored Ape NFTs for greater than US$20 million in September 2021. They’re now going through a lawsuit from a disgruntled purchaser.

As with Bitcoin and comparable speculative tokens, the first driver for getting NFTs was greed. Seeing the preliminary worth rises, folks hoped they too might make enormous earnings. NFTs are basically a superficially refined type of playing. Like Bitcoin, they don’t have any basic worth.

Usually, one would solely revenue from shopping for an NFT by discovering a “greater fool” keen to pay much more for it. So there was by no means a scarcity of individuals – together with some quite famous ones – speaking them up and hoping to instill a concern of lacking out.

Eminem purchased a Bored Ape that seemed a bit like him. Rapper KSI boasted on Twitter about his Bored Ape rising in worth.

For some time there have been giant will increase within the costs of many NFTs. However like all speculative bubbles, it was more likely to finish in tears. Though it’s nearly unimaginable to foretell when a bubble for a speculative asset will burst, we’ve got seen this course of play out earlier than.

Centuries in the past there have been the Dutch tulip, South Sea and Mississippi bubbles. Round 1970, there was a speculative bubble within the shares of nickel miner Poseidon. Then got here the Beanie Baby and dotcom booms of the late Nineteen Nineties – and extra lately, meme stocks and Terra-Luna cryptocurrency.

The NFT crash

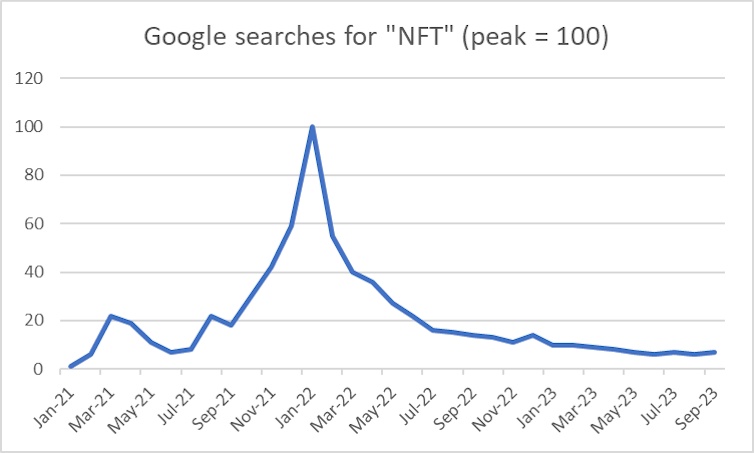

Punters now appear to be as uninterested in NFTs because the apes. Google searches for “NFT” – which grew quickly by means of 2021 – have fallen away dramatically. Buying and selling volumes have collapsed.

One high-profile example is an NFT of the primary tweet by then-Twitter CEO Jack Dorsey. Crypto entrepreneur Sina Estavi bought this NFT for US$2.9 million in March 2021. When he tried to promote it a yr later the highest bid was US$6,800.

What drove the NFT collapse? In addition to shedding their novelty, the market was harm by the big falls within the worth of Bitcoin and different cryptocurrency, in addition to the collapse of the FTX exchange and publicity given to scams.

Past that, the lifting of COVID lockdowns meant individuals who started buying and selling NFTs now had other ways to pass their time. And better rates of interest from mid-2022 made most speculative property appear much less engaging.

Collectively, all of those elements made NFTs seem to be a riskier proposition. Outstanding folks began leaping off the bandwagon. A few of KSI’s later tweets lament the losses he suffered from his gambles.

Final yr, British Prime Minister Rishi Sunak introduced, when he was chancellor of the exchequer (their equal of treasurer), the Royal Mint would produce an NFT. The plan has now been abandoned.

Some silly folks had even taken out loans utilizing the “worth” of their NFTs as collateral. When the lenders needed the cash again, they have been in bother: pressured to promote their NFTs, they bought again a lot lower than they’d paid. Happily, there weren’t sufficient folks like this to result in a systemic drawback within the monetary sector.

Gone for good?

NFTs in all probability received’t fully disappear. Some topics of previous bubbles are nonetheless round. Tulips are nonetheless grown within the Netherlands. Poseidon shares, which ran up from 80 cents in September 1969 to $280 in February 1970, are nonetheless listed (and at present buying and selling for 2 cents).

However until some precise use is discovered for them, NFTs are more likely to fade farther from public dialogue, with their prices increasingly trending down (though the occasional blip up could give die-hard followers some hope).

They are going to in all probability be part of the Dutch tulips and dotcoms within the historical past of speculative follies.![]()

Article written by John Hawkins, Senior Lecturer, Canberra College of Politics, Economics and Society, University of Canberra

This text is republished from The Conversation underneath a Artistic Commons license. Learn the original article.

You may additionally be interested by: